myfashionhouse.ru

Learn

Mrin Stock News

The company reported -$ earnings per share for the quarter, missing the consensus estimate of N/A by -$ Is Marin Software Incorporated overvalued? Oct PM · Marin Software Announces Date of Third Quarter Financial Results Conference Call. (PR Newswire) ; Sep AM · Company News for. Marin Software's Stockholders and Board of Directors Approve Reverse Stock Split. Apr 05, PM. Marin Software Incorporated (NASDAQ: MRIN), a leading. Get the latest Marin Software Inc (MRIN) real-time quote, historical performance, charts, and other financial information to help you make more informed. Latest On Marin Software Inc There is no recent news for this security. Content From Our Affiliates. There is no. A high-level overview of Marin Software Incorporated (MRIN) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Marin Software stock is rising higher on Wednesday as upgraded Micorosoft Advertising integration brings heavy trading of MRIN shares. Research Marin Software's (Nasdaq:MRIN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Get Marin Software Inc (MRIN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The company reported -$ earnings per share for the quarter, missing the consensus estimate of N/A by -$ Is Marin Software Incorporated overvalued? Oct PM · Marin Software Announces Date of Third Quarter Financial Results Conference Call. (PR Newswire) ; Sep AM · Company News for. Marin Software's Stockholders and Board of Directors Approve Reverse Stock Split. Apr 05, PM. Marin Software Incorporated (NASDAQ: MRIN), a leading. Get the latest Marin Software Inc (MRIN) real-time quote, historical performance, charts, and other financial information to help you make more informed. Latest On Marin Software Inc There is no recent news for this security. Content From Our Affiliates. There is no. A high-level overview of Marin Software Incorporated (MRIN) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Marin Software stock is rising higher on Wednesday as upgraded Micorosoft Advertising integration brings heavy trading of MRIN shares. Research Marin Software's (Nasdaq:MRIN) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Get Marin Software Inc (MRIN:NASDAQ) real-time stock quotes, news, price and financial information from CNBC.

Marin Software Incorporated (NASDAQ: MRIN) empowers digital advertisers and agencies with its cutting-edge marketing technology. Marin Software (NASDAQ:MRIN) Stock Quotes, Forecast and News Summary ; Open, $ ; Close, $ ; Volume / Avg. K / M ; Day Range, $ - $ ; 52 Wk. Marin Software Incorporated (MRIN) · About MRIN · Financial Performance · News. Should You Buy or Sell Marin Software Stock? Get The Latest MRIN Stock Analysis, Price Target, Earnings Estimates, Headlines, and Short Interest at. SAN FRANCISCO (AP) — Marin Software Inc. MRIN) on Thursday reported a loss of $2 million in its second quarter. The San Francisco-based company said it had a. Latest MRIN News ; 6 Ways To Finish the Year Richer. 1 hour ago · GOBankingRates ; Tech Shares Likely To Weigh On Taiwan Stocks. 2 hours ago · RTTNews ; Soft Start. Webull provides a variety of real-time MRIN stock news. You can receive the latest news about Marin Software through multiple platforms. Discover real-time Marin Software Incorporated Common Stock (MRIN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Flash News: The Dow Jones rises while the S&P falls and AI stocks extend losses. Nvidia stock stumbles but the decline is expected to be short-lived. Monday, April 29, · Marin Software shares are trading higher afte Benzinga Newsdesk - Apr 29, , PM · Marin Software Launches AI-powered Anomaly. The current price of MRIN is USD — it has increased by % in the past 24 hours. Watch Marin Software Incorporated stock price performance more closely. Track Marin Software Inc (MRIN) Stock Price, Quote, latest community messages, chart, news and other stock related information. Marin Software Inc News & Analysis · Maravai Lifesciences Holdings Inc receives Investment Bank Analyst Rating Update · Marin Software Extends Reach with Reddit. Join thousands of investors who get the latest news, insights and top rated picks from myfashionhouse.ru! Subscribe. Marin Software Incorporated is listed in the Cmp Processing,data Prep Svc sector of the NASDAQ with ticker MRIN. The last closing price for Marin Software was. At the opening of trading on April 15, , Marin's common stock will continue to trade on the Nasdaq Capital Market under the symbol “MRIN,” but will be. View Marin Software (MRIN) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Trade commission-free with the. Ratings · Earnings Call Summary | Marin Software(myfashionhouse.ru) Q2 Earnings Conference · Express News | Marin Software Qtrly Shr Loss $ · Express News | Marin. Marin Software (MRIN) - Provides a cross-channel performance advertising cloud platform for search, social and display advertising. View Marin Software, Inc. MRIN stock quote prices, financial information, real-time forecasts, and company news from CNN.

Home Depot Card Advantages

The Home Depot credit card offers several advantages for consumers. One significant benefit is the option for deferred interest on purchases of $ or more. The Home Depot's commercial credit card provides easy-to-read, itemized billing statements organized by product number and includes posted date, sku, total . Credit Card Services - The Home Depot · 6 months to purchase everything for your project* · Fixed low monthly payments with more time to pay and flexibility to. Enjoy Even More Benefits · $0 fraud liability · No annual feeFootnote · Free access to Your Credit Score · Mobile appFootnote (iOS & Android). Spend $ or more, get $30 back, up to 2 times (total of $60). Get a $30 statement credit by using your enrolled eligible Card to spend a minimum of $ Home Depot ®; Ikea ®; Kohl's ®; Lowe's ®; Lululemon ®; Macy's ™; Menards Looking for a credit card with different benefits? Compare all credit cards. Use. Earn 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all. Pro Xtra Perks is a benefit of the Program which enables Members to earn rewards (“Perks”) on up to $1,, of Qualifying Purchases in any Program Period . Because the Home Depot Credit Card does not offer regular rewards, its main benefits are a first-purchase discount and deferred interest financing promotions. The Home Depot credit card offers several advantages for consumers. One significant benefit is the option for deferred interest on purchases of $ or more. The Home Depot's commercial credit card provides easy-to-read, itemized billing statements organized by product number and includes posted date, sku, total . Credit Card Services - The Home Depot · 6 months to purchase everything for your project* · Fixed low monthly payments with more time to pay and flexibility to. Enjoy Even More Benefits · $0 fraud liability · No annual feeFootnote · Free access to Your Credit Score · Mobile appFootnote (iOS & Android). Spend $ or more, get $30 back, up to 2 times (total of $60). Get a $30 statement credit by using your enrolled eligible Card to spend a minimum of $ Home Depot ®; Ikea ®; Kohl's ®; Lowe's ®; Lululemon ®; Macy's ™; Menards Looking for a credit card with different benefits? Compare all credit cards. Use. Earn 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all. Pro Xtra Perks is a benefit of the Program which enables Members to earn rewards (“Perks”) on up to $1,, of Qualifying Purchases in any Program Period . Because the Home Depot Credit Card does not offer regular rewards, its main benefits are a first-purchase discount and deferred interest financing promotions.

and earn Perks. And don't forget to register your tender for automatic purchase tracking whenever you use your card. Download The Home Depot mobile app. How You Earn ; 6% CASH BACK On Groceries. On Groceries. Up to $6, per year in purchases at U.S. supermarkets. ; 6% CASH BACK On Select Streaming Subscriptions. Add a credit card for quick and easy checkout the next time you shop. Pay & Manage Your CardCredit Offers. Get $5 off when you sign up for emails. Get access to finance offers at Home Depot with the Home Depot Credit Card. Plus, pay no annual fee. Every $1 spent on your card counts as $4 for purposes of earning Perks. There are minimum spend thresholds and limits to the amount of Perks that you may earn. AAA Visa Signature® credit cards. $ cash back paid as a statement credit.¹ · NFL Extra Points Visa® Credit Card. $ cash back. · Victoria's Secret Mastercard. One of the significant attractions of the Home Depot Consumer Credit Card is the six months of 0% financing for purchases of $ or more. These special. Commercial Credit Cards · Access to exclusive Pro Xtra Loyalty Program benefits when you sign up · No annual fee · Flexible payment options · Easy-to-read, SKU. For your road trip, your everyday commuting and beyond, cash back on gas and electric vehicle charging station purchases can add up when you're on the go. Earn. Unlike most store credit cards, it doesn't give ongoing rewards, but it does offer an introductory APR of 0% for 6 - 12 months on purchases. This is deferred. They regularly offer 12 month no interest financing on purchases over $ but will mail promotional offers of 24 month 0% interest financing. The Home Depot Card has two benefits outside of delayed interest: an extended return window and $0 fraud liability. Cardholders can make a return up to one year. One of the significant attractions of the Home Depot Consumer Credit Card is the six months of 0% financing for purchases of $ or more. These special. Your account must be open and current to be eligible for this offer. For eligible purchases, the purchase amount is divided into 12 equal monthly payments and. What is the Home Depot Consumer Credit Card? · No annual fee · 6 months financing on $+ · Up to 24 months financing during special promotions · Longer return. Take advantage of various competitive personal and business deposit accounts and loans that are offered by The Bank of Missouri. Visit our website today. You can use our gas card at every Home Depot location as well as more than , fuel and maintenance locations throughout the country. This gives your. What are the best home improvement credit cards? · Destiny credit card · Home Depot Consumer Credit Card · Lowe's Advantage card · U.S. Bank Shopper Cash Rewards. Home Equity Offers & Benefits · Home Equity Resources · Home Project Financing Click Go to Member Deals in the Card Benefits section. Go to Member.

Veteran Home Lenders

CalVet Home Loans CalVet Home Loans logo. Helping veterans and their families become homeowners for more than years. A smiling veteran and their family. VA Loan Benefits · No Down Payment. In most cases, a VA loan allows you to purchase your new home with no money down. · Competitive Interest Rates. VA loans. We're here to help you through the home-buying experience by providing low VA home loan rates, resources and membership benefits. If you're interested in learning more about New York VA mortgages and believe you might meet the eligibility requirements, give us a call today at AmeriSave offers competitive, low interest rates with no loan origination fees on VA home loans. See if you qualify today. VA. We have compiled a list of 10 Best VA Home Loan Lenders In United States that you can choose for financing your dream house. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility. Current VA loan interest rates. VA loan rates are slightly lower than rates for other mortgage types. The year VA loan rate averaged percent as of March. USAA Bank is ranked one of the top VA mortgage lenders. 20+ Years USAA Bank has more than 20 years of experience with VA home loans. CalVet Home Loans CalVet Home Loans logo. Helping veterans and their families become homeowners for more than years. A smiling veteran and their family. VA Loan Benefits · No Down Payment. In most cases, a VA loan allows you to purchase your new home with no money down. · Competitive Interest Rates. VA loans. We're here to help you through the home-buying experience by providing low VA home loan rates, resources and membership benefits. If you're interested in learning more about New York VA mortgages and believe you might meet the eligibility requirements, give us a call today at AmeriSave offers competitive, low interest rates with no loan origination fees on VA home loans. See if you qualify today. VA. We have compiled a list of 10 Best VA Home Loan Lenders In United States that you can choose for financing your dream house. Forbes Advisor compiled a list of VA loan lenders that excel in various areas, including offering low fees, convenience and flexibility. Current VA loan interest rates. VA loan rates are slightly lower than rates for other mortgage types. The year VA loan rate averaged percent as of March. USAA Bank is ranked one of the top VA mortgage lenders. 20+ Years USAA Bank has more than 20 years of experience with VA home loans.

Landing page with resources and links to information for VA home loan guaranty lenders.

You can buy or build a home, or refinance an existing home mortgage, with as little as $0 down, great rates and financing with no mandated cap. VA home loans · No down payment options · Borrow up to % of the home's value with a cash out refinance · Rate and term refinance options · No private. Active personnel, veterans, and reservists dreaming of a home can turn to VA home loans for exclusive rates with no down payment requirements. We currently lend in all of Washington, Oregon, Idaho, Colorado and California and have providing borrowers with mortgage programs since NewDay USA is a VA home loan mortgage lender that offers streamline refinance, zero down loan, and other options for qualified Veterans. Get better rates and lower down payments. The Veteran Affairs (VA) Home Loan federal program helps Soldiers and veterans get better terms and benefits when. With a VA Loan you can often buy a home with no down payment, refinance up to % of your home's value and take advantage of your valuable VA Loan benefits. Compare these top mortgage lenders to find the right VA loan for you. Here are the best VA mortgage lenders to consider. VA loans from Wells Fargo are available to active-duty and veterans of the armed forces. Learn more about the benefits, rates, and requirements of VA home. VA loan from PNC Bank is a home loan and mortgage option for Active Military, Veteran, Reservist or National Guard. We're here to offer specialized help in exploring your eligibility for VA loan benefits and other government-backed home loan programs. Lenders like USAA and Veterans United don't have stellar reputations (deservedly), and it doesn't matter that they claim to specialize in VA loans. Veterans Lending Group is your trusted VA specialty mortgage lender. If you are a Service Member, Veteran, or Military Spouse, you may qualify for the VA Home. The Department of Veterans Affairs (VA) Home Loan program guarantees loans made to eligible Veterans, Servicemembers, Reservists, National Guard members and. Members with six or more years of Guard service, or those with 90 days of continuous federal Active Duty service (Title 10), are eligible for the "VA Home Loan. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City. VA loans are issued through approved lenders like Embrace and are guaranteed by the Federal Government through the U.S. Department of Veterans Affairs (VA). VA. Texas Premier Mortgage is a qualified VA Loan Lender servicing clients in The Woodlands, Spring TX, Conroe TX, and does business in surrounding areas such as. A VA loan makes it easier for veterans, active duty military members and eligible surviving spouses to purchase or refinance their home. A VA loan is a special type of mortgage created specifically to help veterans become homeowners. VA home loans have more lenient requirements than conventional.

Binance Smart Chain Transactions

Binance Smart Chain is a new platform that aims to lower transaction costs and provide a space to create DApps and other DeFi products. BSC, which has emerged as a low-fee smart contract blockchain, was created by crypto exchange Binance as a parallel blockchain to its pre-existing Binance Chain. Binance Smart Chain Transactions Per Day is at a current level of M, down from M yesterday and up from M one year ago. finance (DeFi). Key Features and A layer-2 scaling solution for BNB Smart Chain that significantly increases transaction speed and reduces fees. How to recover assets sent on BNB Smart Chain · Step 1. First, double-check that your tokens are on the BSC network. · Step 2. Switch to BNB Smart Chain network. I have made a few % transactions on Binance Smart Chain (BSC / BEP20) between Binance and Trust Wallet (% because the fee is BNB so not affecting the. BNB Beacon Chain sunset is in progress. Please take action to manage your assets. Learn More close. logo. BNB BEACON CHAIN EXPLORER. BNB. $ +%. View the list of our pre-built BSC integrations here. Uncategorized transactions. Note - if you swapped crypto from smart contracts that CoinLedger does not. Learn how to identify and override pending transactions on BNB Smart Chain using the myfashionhouse.ru Wallet app. Binance Smart Chain is a new platform that aims to lower transaction costs and provide a space to create DApps and other DeFi products. BSC, which has emerged as a low-fee smart contract blockchain, was created by crypto exchange Binance as a parallel blockchain to its pre-existing Binance Chain. Binance Smart Chain Transactions Per Day is at a current level of M, down from M yesterday and up from M one year ago. finance (DeFi). Key Features and A layer-2 scaling solution for BNB Smart Chain that significantly increases transaction speed and reduces fees. How to recover assets sent on BNB Smart Chain · Step 1. First, double-check that your tokens are on the BSC network. · Step 2. Switch to BNB Smart Chain network. I have made a few % transactions on Binance Smart Chain (BSC / BEP20) between Binance and Trust Wallet (% because the fee is BNB so not affecting the. BNB Beacon Chain sunset is in progress. Please take action to manage your assets. Learn More close. logo. BNB BEACON CHAIN EXPLORER. BNB. $ +%. View the list of our pre-built BSC integrations here. Uncategorized transactions. Note - if you swapped crypto from smart contracts that CoinLedger does not. Learn how to identify and override pending transactions on BNB Smart Chain using the myfashionhouse.ru Wallet app.

If you want to cancel an unconfirmed transaction on Binance, you can do so by navigating to the "Transactions" page on the Binance website. On. Launched by the cryptocurrency exchange Binance, BNB Smart Chain (BSC), previously Binance Smart Chain, is a blockchain network. It supports smart contracts. BSC runs in parallel with Binance's native Binance Chain (BC), which allows users to get the best of both worlds: the high transaction capacity of BC and the. BSC (Binance Smart Chain) is a blockchain made to run on smart contracts, similar to Ethereum. The main purpose of BSC is to optimize fast trading and. Search Binance (BNB) Smart Chain Mainnet transactions, address, blocks, and miners on the blockchain, and check your Binance (BNB) Smart Chain Mainnet. Binance has two types of chains: BNB Beacon Chain BSC Smart Chain. BNB is the native asset of both chains. BNB Smart Chain (BSC) - BEP20 In the Tatum v3. BNB is also used as a utility token that allows users to receive discounts on transaction fees when trading on the Binance centralized cryptocurrency exchange. Binance Smart Chain Average Transaction Fee is at a current level of , down from yesterday and up from one year ago. This is a change of -. The BNB Chain, formerly known as Binance Smart Chain (BSC), is a blockchain platform introduced by the cryptocurrency exchange Binance. BSC is well known for its lightning-fast transactions. In a Binance smart chain, the blocks are made every 3 seconds, unlike Ethereum, which takes 13 seconds to. OKLink BNB Chain blockchain explorer is the world's leading blockchain search engine. It supports BNB Chain blocks, addresses, transactions, tokens. We'll discuss the basics of cryptocurrency taxation and share a simple 3-step process to help you report your Binance Smart Chain taxes in minutes. We're sorry to hear you're having trouble with your transaction. Please know that when making transactions on the Binance Smart Chain (BSC), BNB. Bep20Swap (BEP20) Token in Binance (BNB) Smart Chain Mainnet. Smart Contract with address: 0xd98e2ff0fb52edb4eb15bbac84cf1d3. Smart Contracts developed for Ethereum can also be used in Binance Smart Chain? 1 · How to make sure a trade is executed with binance python · 0. The Binance Smart Chain (BSC) is now the BNB Chain. BSC, crypto exchange Binance's layer-1 blockchain, recently announced the merger of the Binance Smart. To organize your transactions from Binance Smart Chain for tax purposes, you will need to import your full transaction history. In the 'Integrations' tab in our. Binance Smart Chain (BSC) is a chain with low transaction costs and numerous developer tools to build DApps and other DeFi products. BNB was launched in Launched by the cryptocurrency exchange Binance, BNB Smart Chain (BSC), previously Binance Smart Chain, is a blockchain network. It supports smart contracts. Discover the inner workings of BscScan and how it serves as an essential tool for monitoring Binance Smart Chain transactions and assets in this guide.

Lawn Mower Repair Ann Arbor

See reviews for COUNTRYSIDE LAWN & GARDEN EQUIPMENT in Ann Arbor, MI at JACKSON RD from Angi members or join today to leave your own review. While lawn mower repair shops have been around Ann Arbor for years, YardSimply has raised the bar with turbocharged services at honest prices. Lawn Mower Service · Tune Up · Maintenance Package · Repair · Riding Lawn Mower Tune Up · Maintenance Package · Repair · Trimmer and Edger Service · Tune Up. Ready to mow riding lawnmower 1 · Ready to mow riding lawnmower. 6/11 · Van buren township ; Poulon Pro Lawnmower 1 · Poulon Pro Lawnmower. 6/4 · Ann Arbor. Home Dave's Engine & Mower, Inc. Westland, MI () Contact Mobile Mower Repair at: Professional Lawn Mower Repair in Ann Arbor MI is available from Mobile Mower Repair. Mobile Mower has been serving Washtenaw and Livingston Counties for over 32 years. We understand the need for dependable and efficient repairs. Our certified. Larry's Mower Shop is a local business in Ann Arbor, MI that specializes in providing maintenance and repair services for a variety of outdoor power equipment. I COME TO YOU - Tractor, Lawn Mower, Snow Blower, Generator REPAIR SERVICE AT YOUR HOME TODAY - Call for an appt. See reviews for COUNTRYSIDE LAWN & GARDEN EQUIPMENT in Ann Arbor, MI at JACKSON RD from Angi members or join today to leave your own review. While lawn mower repair shops have been around Ann Arbor for years, YardSimply has raised the bar with turbocharged services at honest prices. Lawn Mower Service · Tune Up · Maintenance Package · Repair · Riding Lawn Mower Tune Up · Maintenance Package · Repair · Trimmer and Edger Service · Tune Up. Ready to mow riding lawnmower 1 · Ready to mow riding lawnmower. 6/11 · Van buren township ; Poulon Pro Lawnmower 1 · Poulon Pro Lawnmower. 6/4 · Ann Arbor. Home Dave's Engine & Mower, Inc. Westland, MI () Contact Mobile Mower Repair at: Professional Lawn Mower Repair in Ann Arbor MI is available from Mobile Mower Repair. Mobile Mower has been serving Washtenaw and Livingston Counties for over 32 years. We understand the need for dependable and efficient repairs. Our certified. Larry's Mower Shop is a local business in Ann Arbor, MI that specializes in providing maintenance and repair services for a variety of outdoor power equipment. I COME TO YOU - Tractor, Lawn Mower, Snow Blower, Generator REPAIR SERVICE AT YOUR HOME TODAY - Call for an appt.

I didn't have a lawn mower for the start of the season and now my grass is too long for mine. I'd really like to hire someone to mow my lawn. This organization is not BBB accredited. Lawn Mower Repair in Ann Arbor, MI. See BBB rating, reviews, complaints, & more. Visit the Husqvarna store at JACKSON RD, ANN ARBOR, MI. Find address, phone number, email, in store services and sales in Husqvarna stores in Michigan. Boyd's He Cutter Lawn Services in Ann Arbor, MI. Hired times on GreenPal. lawn-maintenance-in-Ann Arbor-MI. Many locals have sought their expertise for issues ranging from lawn mower engine fixes to snowblower tune-ups. The shop is known for its knowledgeable staff. Details · Orion Automotive Services. (1) · Imperial Auto Service. Jackson Plz, Ann Arbor, MI · Mobile Mower Repair Inc. (1) · Auto Parts Machine Shop &. All Seasons Landscaping specializes in high quality outdoor power equipment repairs. Whether you need yearly maintenance, belts, transmission work. From eco-friendly, quiet lawn maintenance to snow removal, Electric Lawn Company provides reliable, quality service lawn mower. It almost evens out, but we. Showing: results for Lawn Mower Repair near Ypsilanti, MI ; Harry's Auto Service, LLC. Auto Services, Lawn Mower Repair, Tire Dealers · () Does anyone have a recommendation or ideas for a place in or near Ann Arbor that can repair my electric lawnmower? I have an EGO Power+ that is literally six. The Mower Doctor is a fully mobile, full service lawn mower repair company located in beautiful New Hudson, Michigan. Our mobile repair center allows us to save. myfashionhouse.ruyside Lawn & Garden Equipment. Jackson Rd. Ann Arbor, MI. (3). 23 Years. in Business · Lawn Mowers-Sharpening & RepairingEngine. LARRY'S MOWER SHOP - CLOSED, Jackson Rd, Ann Arbor, MI , 8 Photos lawn mower needed repair after the 2nd use. A new carburetor was. Ann Arbor, Chelsea, Pinckney, Hamburg, Howell, South Lyon, Manchester, Jackson, Saline, and Brighton. We are your Factory Authorized Sales and Repair Center. 1 Mapadd google map to websiteMap of Ann Arbor, Michigan, United States. About Us. We service all makes, models, and types of lawn and garden equipment, as. We repair, service and sell parts for small engines and outdoor power equipment from your lawn mower to your snow blower, generator, riding lawn mower ect. We are your lawn, garden & construction equipment dealer in MI. Shop Bobcat, Massey Ferguson & AGCO tractors, mowers, excavators, skid steers, UTVs & more. small engine mechanic jobs in ann arbor, mi. 27 jobs. Small Engine Mechanic (1 small engine repair · small engine technician · small engine · mechanic · lawn. The Ace Hardware store I purchased my lawn mower and snow blower from is an official repair location. The website does have a Customer. Shop the best Honda lawn mowers, including walk behind mowers and commercial mowers at Weingartz Supply Co. located in Ann Arbor, MI.

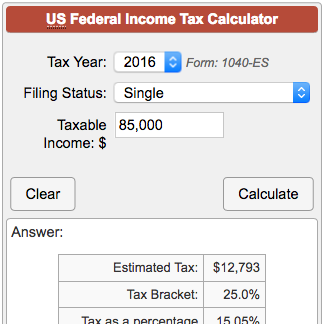

How Do I Determine My Tax Rate

To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much. Download the Tax Rate Table here! Virginia Taxable Income. Calculate. Virginia Tax Amount. How Virginia Tax is Calculated. Va Taxable Income, Tax Calculation. This is the formula you need to use to calculate your effective tax rate: Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax. Your marginal tax rate is the percentage of tax you pay on your last dollar of taxable income. · Your average tax rate is just that—the average amount that you. Use our Tax Calculator. Tax Bracket Calculator. Enter your tax year filing status and taxable income to calculate your estimated tax rate: What is my tax rate? Type an address above and click "Search" to find the sales and use tax rate for that location. All fields required. You can easily figure out your effective tax rate by dividing the total tax by your taxable income from Form For corporations, the effective tax rate is. This is the percentage paid in Federal taxes on additional income. To determine your marginal tax rate, the tool recalculates your total Federal income tax. Current Income Tax Rates and Brackets. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much. Download the Tax Rate Table here! Virginia Taxable Income. Calculate. Virginia Tax Amount. How Virginia Tax is Calculated. Va Taxable Income, Tax Calculation. This is the formula you need to use to calculate your effective tax rate: Effective Tax Rate = Total Tax ÷ Taxable Income. Effective Tax Rate vs. Marginal Tax. Your marginal tax rate is the percentage of tax you pay on your last dollar of taxable income. · Your average tax rate is just that—the average amount that you. Use our Tax Calculator. Tax Bracket Calculator. Enter your tax year filing status and taxable income to calculate your estimated tax rate: What is my tax rate? Type an address above and click "Search" to find the sales and use tax rate for that location. All fields required. You can easily figure out your effective tax rate by dividing the total tax by your taxable income from Form For corporations, the effective tax rate is. This is the percentage paid in Federal taxes on additional income. To determine your marginal tax rate, the tool recalculates your total Federal income tax. Current Income Tax Rates and Brackets. The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1).

Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. The marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. Multiply the applicable county and municipal/district combined tax rate to the county tax appraisal of the property My taxes would be: $, Your filing status determines the income levels for your Federal tax rates. Choose 'Both myself and my spouse' if you both are dependents. You are a. Understanding the 7 tax brackets the IRS uses to calculate your taxes can help you figure out your federal effective tax rate. Here's what you need to know. TaxAct's free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. The federal income tax bracket determines a taxpayer's tax rate. There are seven tax rates for the tax season: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Federal income tax is calculated using a progressive tax structure, meaning that your effective tax rate is lower than your income tax bracket. Why? As this. Rates are available by city grouped by county, alphabetical by city, and in Excel or QuickBooks file format. Determine the location of my sale. Sales tax. Use our income tax calculator to estimate how much you'll owe in taxes. Enter your income and other filing details to find out your tax burden for the year. Estimate your federal income tax withholding · See how your refund, take-home pay or tax due are affected by withholding amount · Choose an estimated withholding. Since your tax bracket is based on taxable income, it's important to have an estimate of your income. Start with your last filing. You can then adjust your. You can determine what your effective tax rate is by dividing your total tax by your taxable income on your federal tax return. On Form , divide the figure. Tax bracket rates can change from year to year, so it's important to research the rates as listed by the IRS when calculating your owed income tax for the year. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. You should use your average tax rate when estimating your total tax liability for a year. For example, if you are planning your retirement and wish to estimate. MyTax Illinois Tax Rate Finder - Online tool used to look-up by individual determine origin-based sales tax rates. Machine Readable Files - Address. Determine Household Income · Homestead Declaration · Businesses · Property · Tax Where's my Refund? Return to top. Copyright © State of Vermont All. To verify the tax rate for a location: · Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates. Identify your federal income tax bracket based on current IRS tax rate schedules Do Not Sell or Share My Personal Information. The funds referred to in.

Best Car Navigation System

Google Maps remains the gold standard for navigation apps due to its superior directions, real-time data, and various tools for traveling in urban and rural. Navigational systems offer the best routes between two points. External technologies like the Global Positioning System (GPS) and satellite-based radio. Advanced GPS navigator with a " display, Bluetooth, voice-activated operation and live traffic. "" Garmin DriveSmart 65 & Traffic. Advanced GPS navigator. Buy GPS Navigation for Car 7" Touchscreen 8GB+M Vehicle GPS Navigator System Real Voice Spoken Turn Direction Reminding GPS for Car with Lifetime Free. The Garmin Drive 53 & Traffic is one of the smallest, most affordable navigation devices you can get for your car. It has a 5-inch touch screen and comes with. An in-dash nav system eliminates the need to constantly look down at your phone, which can be a major distraction while driving. When you use your phone for. Take your next road trip with confidence. SafeWise reviews the best GPS systems with hassle-free features to safely get you where you need to go. providing brand-quality items at a reasonable price! Discover the best GPS navigation for cars. Discover Our navigator deals. XGODY is the best Store where to. The Garmin DriveSmart 66 combines a number of great portable features, including traffic and map updates, Bluetooth, lane guidance, junction view, a large. Google Maps remains the gold standard for navigation apps due to its superior directions, real-time data, and various tools for traveling in urban and rural. Navigational systems offer the best routes between two points. External technologies like the Global Positioning System (GPS) and satellite-based radio. Advanced GPS navigator with a " display, Bluetooth, voice-activated operation and live traffic. "" Garmin DriveSmart 65 & Traffic. Advanced GPS navigator. Buy GPS Navigation for Car 7" Touchscreen 8GB+M Vehicle GPS Navigator System Real Voice Spoken Turn Direction Reminding GPS for Car with Lifetime Free. The Garmin Drive 53 & Traffic is one of the smallest, most affordable navigation devices you can get for your car. It has a 5-inch touch screen and comes with. An in-dash nav system eliminates the need to constantly look down at your phone, which can be a major distraction while driving. When you use your phone for. Take your next road trip with confidence. SafeWise reviews the best GPS systems with hassle-free features to safely get you where you need to go. providing brand-quality items at a reasonable price! Discover the best GPS navigation for cars. Discover Our navigator deals. XGODY is the best Store where to. The Garmin DriveSmart 66 combines a number of great portable features, including traffic and map updates, Bluetooth, lane guidance, junction view, a large.

Navigation systems use the Global Navigation Satellite System (GNSS) network to pinpoint the location of your car anywhere on the globe. TomTom navigation software is the top choice of carmakers around the world. Developed for automotive developers, it's backed by a dedicated integration and. Discover the most reliable GPS tracker for car with PAJ GPS. Advanced vehicle tracking technology for safety and peace of mind in USA. Cobra's Nav One is sort of the best and worst of portable navigation systems — it works exceptionally well yet isn't very portable. Finally, at $ it's near. Find the Most Reliable GPS Navigation for Your Car · Magellan RoadMate T-LMB · Magellan RoadMate T-LM · Magellan RoadMate LM · Garmin nuvi 68LMT. Garmin DriveSmart 55 & Traffic: GPS Navigator with a ” Display, Hands-Free Calling, Included Traffic alerts and Information to enrich Road Trips (Renewed). We tested GPS trackers for kids—including kids smartwatches—to bring you our faves based on GPS tracking, location accuracy, alerts, portability and battery. A comprehensive GPS buying guide that will give you all the information you need on how to buy a new GPS Unit. An in-dash nav system eliminates the need to constantly look down at your phone, which can be a major distraction while driving. When you use your phone for. Adding a navigation system to your car will improve its resale value, and it will function even if you're outside cell service and smartphone guidance fails. If. Google Maps remains the gold standard for navigation apps due to its superior directions, real-time data, and various tools for traveling in urban and rural. Good idea (to buy portable gps nav system); which model do you recommend? Latrevisana ·. 6 years ago. salt lake city · 9, forum posts. #14 of Top Cars, Trucks and SUVs with a Navigation System Compare the Acura MDX Side-by-Side against other vehicles. Compare the Acura MDX Side-by-Side. Car GPS with reverse camera: This feature combines the functionality of a GPS navigation system with a rear-view camera and provides. Adding a navigation system to your car will improve its resale value, and it will function even if you're outside cell service and smartphone guidance fails. If. Garmin delivers full-featured car GPS navigation systems, dash cams and wireless backup cameras. The Latest In GPS Navigation Technology · Eclipse. Eclipse has 3 excellent integrated systems. · Kenwood. Kenwood's navigation solutions involve an add-on unit. That's why we offer top-of-the-line car navigation/GPS systems that offer the latest features such as hands-free control for improved safety on the road. Our. best meets some criteria (shortest, cheapest, fastest, etc.) Mazda Eunos Cosmo became the first production car with built-in GPS-navigation system. TomTom navigation software is the top choice of carmakers around the world. Developed for automotive developers, it's backed by a dedicated integration and.

Compound Interest On Investment

Formula for calculating the final value of an investment that's compounded: Amount = P (1 + r/n) nt. P = initial investment;; r = interest rate; t. Your money earns money over time, usually through interest or dividends. Then you earn money on your initial investment and the earnings. This is compounding. Compounding interest calculator: Here's how to use NerdWallet's calculator to determine how much your money can grow with compound interest. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. Compound interest investments can potentially drive returns over a long period, but there are a few things to consider. Here's what to know. How compound interest works The original sum of money invested, or the amount borrowed or still owing on a loan. For example, if you have a savings account. The idea of compound interest (as compared to simple interest) is fundamental to investing because it can ultimately lead to a greater return in your account. Compounding typically refers to the increasing value of an asset due to the interest earned on both a principal and an accumulated interest. This phenomenon. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. Formula for calculating the final value of an investment that's compounded: Amount = P (1 + r/n) nt. P = initial investment;; r = interest rate; t. Your money earns money over time, usually through interest or dividends. Then you earn money on your initial investment and the earnings. This is compounding. Compounding interest calculator: Here's how to use NerdWallet's calculator to determine how much your money can grow with compound interest. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts. Compound interest investments can potentially drive returns over a long period, but there are a few things to consider. Here's what to know. How compound interest works The original sum of money invested, or the amount borrowed or still owing on a loan. For example, if you have a savings account. The idea of compound interest (as compared to simple interest) is fundamental to investing because it can ultimately lead to a greater return in your account. Compounding typically refers to the increasing value of an asset due to the interest earned on both a principal and an accumulated interest. This phenomenon. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest.

Don't forget compounding intervals – The more frequently investments are compounded, the higher the interest accrued. It is important to keep this in mind when. Normally, the more periods involved in an investment, the more compounding of return is accrued and the greater the rewards. While they are not fixed-interest. Suppose we stick with an example similar to the one above. You invest $1, in an account at a bank, but this time the bank is promising to pay you an annual. Compound Interest Calculator. Determine how much your money can grow using the power of compound interest. Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.) In other words, you earn interest on both. Compound interest is interest that applies not only to the initial principal of an investment or a loan, but also to the accumulated interest from previous. Compound interest investment calculator · Daily: Daily compounding is when today's balance earns interest, and that new balance earns more interest tomorrow, and. Compounding is when you earn interest on your investment over a period of time, due to which you witness a growth on your earnings. Power of compounding enables. The annual interest rate for your investment. The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's ®. Investment Products · Auction Rate Securities; Bonds or Fixed Income Products Compound Interest. Interest paid on principal and on accumulated interest. Formula for calculating the final value of an investment that's compounded: Amount = P (1 + r/n) nt. P = initial investment;; r = interest rate; t. Examples of Compound Interest · Savings accounts, checking accounts and certificates of deposit (CDs). · (k) accounts and investment accounts. · Student loans. Compounding is a powerful investing concept that involves earning returns on both your original investment and on returns you received previously. The time your investments have to grow is just as important as the amount you invest. That's because compound interest can have a big impact on long-term. Don't just save — invest! To take advantage of compound interest, your savings must be in an account that pays some kind of return on investment. That rate will. Find out how your investment will grow over time with compound interest. Initial investment: $. 0. $ Enter the amount of money you will invest up front. Simple interest is calculated based on the amount you invest (also called the principal amount). Compound interest, on the other hand, is accumulated based on. Compounding is the process where any return earned on an investment gets added to the principal amount invested. The interest rate is then applied to that new. To take full advantage of the power of compound interest, investments must be allowed to grow and compound for long periods. The Motley Fool has a disclosure. With the compound interest formula, you can determine how much interest you will accrue on the initial investment or debt. You only need to know how much your.

Difference Between S Corp C Corp

Comparing C corp, S corp, and LLC: At a glance · C corporations, S corporations, and LLCs provide limited liability protection for the personal assets of the. The S and C letters stand for the tax status: an S corporation is taxed like a partnership, while a C corporation is taxed like it is its own person. An LLC can also elect to be taxed as an S corp. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C. C-Corps are larger and can have more than shareholders as stated above but the business must pay corporate income taxes. S-Corps are smaller and cant have. Single layer of taxation: The main advantage of the S corp over the C corp is that an S corp does not pay a corporate-level income tax. So any distribution of. S Corps are ideal for smaller businesses that want to avoid double taxation, while C Corps may be able to access lower corporate tax rates. S Corps offer more. Let's break down each entity to help you determine whether an S Corp or C Corp is the best fit for your business. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S. Comparing C corp, S corp, and LLC: At a glance · C corporations, S corporations, and LLCs provide limited liability protection for the personal assets of the. The S and C letters stand for the tax status: an S corporation is taxed like a partnership, while a C corporation is taxed like it is its own person. An LLC can also elect to be taxed as an S corp. The difference between an S and a C corp involves the way they pay taxes under the Internal Revenue Code. A C. C-Corps are larger and can have more than shareholders as stated above but the business must pay corporate income taxes. S-Corps are smaller and cant have. Single layer of taxation: The main advantage of the S corp over the C corp is that an S corp does not pay a corporate-level income tax. So any distribution of. S Corps are ideal for smaller businesses that want to avoid double taxation, while C Corps may be able to access lower corporate tax rates. S Corps offer more. Let's break down each entity to help you determine whether an S Corp or C Corp is the best fit for your business. Both corporation formats are governed by similar provisions regarding ownership and capital generation. They are separate legal entities that provide limited. The S corporation is subject to the taxing provisions in much the same manner as a partnership. The S corporation files an information tax return, Form S.

C corps permit a wider range of stockholder types than S corps, giving them greater flexibility when seeking investors. S corp income flows to stockholders and. Difference 3. Ownership. A C-corporation will give you more options when it comes to selling stock. According to the IRS, a corporation that chooses S. The S corp vs. C corp comparison brings to light a few important distinctions when it comes to taxes, ownership, and shareholder restrictions. The Major Differences between an S Corp and a C Corp · C Corps: C corps are separate taxable entities and as a result, they must file a corporate tax return via. The main difference between an S Corp and a C Corp is how they're taxed. C Corp status business owners pay taxes twice — at the corporate and individual level. The primary difference between an S corp and a C corp is the manner in which they are taxed by the IRS. A C corp has its profits and losses stay in the business. It's possible for an S-corp to become a C-Corp, as long as it meets the eligibility requirements, including not having more than shareholders or more than. Unless the owner filed an S election, most corporations are C corporations by default. These companies are taxed on their own income at the current corporate. Although S corporations cannot convert to LLC/tax partnership form on a tax-free basis, they can become C corporations without tax simply by revoking their S. The main difference between a C corporation and an S corporation is the taxation structure. S corporations only pay one level of taxation: at the shareholder. The Main Differences Between C Corps and S Corps · Tax Status: C corps are subject to corporate income tax and potential double taxation. · Distribution of. C Corporation vs. S Corporation An S corporation is another type of business structure that allows a company to pass its income, deductions, and losses to its. An S corp (or S corporation) is a business structure that is permitted under the tax code to pass its taxable income, credits, deductions, and losses directly. AC corporation becomes an S corporation only when, with the consent of all shareholders, special tax treatment (“pass-through taxation”) is sought. The key difference between an S corporation and a C corporation is how they are taxed. C corporations are subject to double taxation. An S corp is a business structure and tax election that allows the business to pass through all its income as well as any deductions, credits and losses to its. S Corporation vs C Corporation vs LLC ; Federal Tax Treatment, Pass through entity. Taxed once on shareholders. No corporate level taxation. Still file corp tax. The biggest difference is taxation. AC Corp is taxed based on the income it earns. AS Corp is not (state level 'franchise' fees may apply, depending upon what. C corporations and S corporations are different tax designations available to corporations. Each has its pros and cons, and the best choice for you will depend. S corporations may be better suited for smaller-sized businesses, since they can have no more than shareholders participating as owners of the company. C.

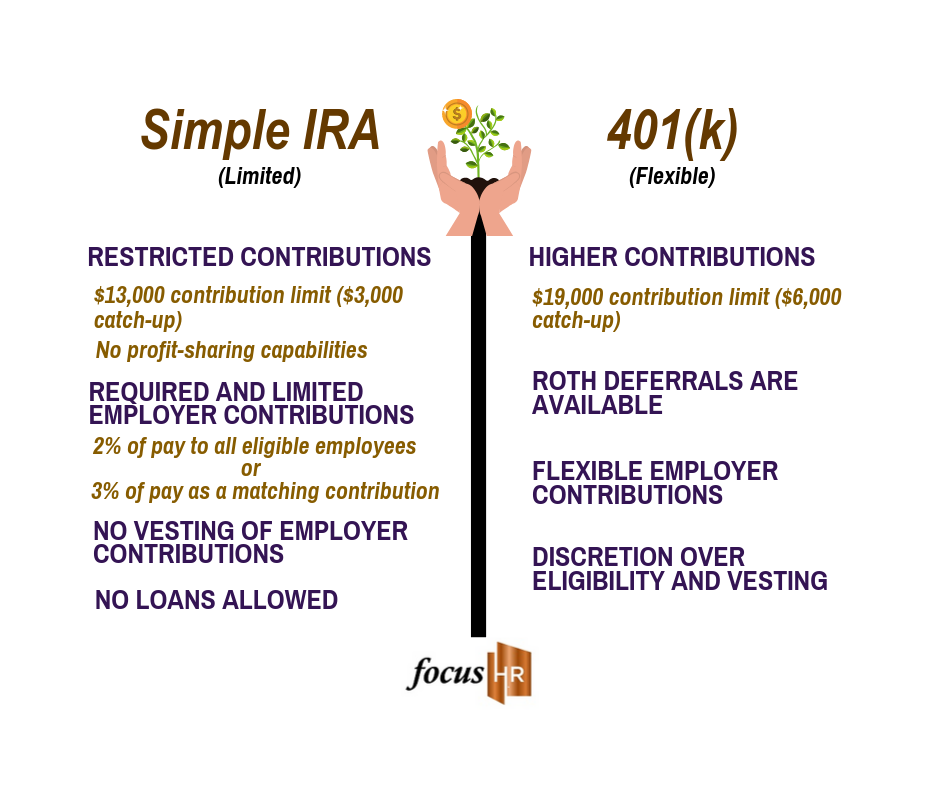

401k Vs Ira Calculator

Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. Estimate your retirement savings with this variety of the best retirement calculators—that are free to use. Calculate a retirement plan that works for you. Let Citizens help inform your retirement strategy with our Traditional (k) vs. Roth (k) calculator that compares costs and savings scenarios. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. Use this tool to determine which IRA may be right for you. Please note, this calculator should not be used for Roth (k) comparisons. Retirement Planning. Our Wealth Advisors are here to help you prepare for your financial future. Learn More. See All Calculators. Let's Go. Compare retirement savings options with our k vs IRA Calculator at First Merchants Bank. Make an informed choice for your financial future. Traditional IRA. Use this calculator to determine which IRA may be right for you. Roth vs. Traditional (k) and. Traditional or Roth contributions? Use this calculator to help determine which one is better for your situation. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. Estimate your retirement savings with this variety of the best retirement calculators—that are free to use. Calculate a retirement plan that works for you. Let Citizens help inform your retirement strategy with our Traditional (k) vs. Roth (k) calculator that compares costs and savings scenarios. Because converting will require you to pay taxes on the amount converted, we'll help you compare the impact of paying taxes on the converted amount today vs. Use this tool to determine which IRA may be right for you. Please note, this calculator should not be used for Roth (k) comparisons. Retirement Planning. Our Wealth Advisors are here to help you prepare for your financial future. Learn More. See All Calculators. Let's Go. Compare retirement savings options with our k vs IRA Calculator at First Merchants Bank. Make an informed choice for your financial future. Traditional IRA. Use this calculator to determine which IRA may be right for you. Roth vs. Traditional (k) and. Traditional or Roth contributions? Use this calculator to help determine which one is better for your situation.

Both of you need to max your Traditional K, backdoor Roth IRA, and HSA accounts. Then, add another $K annually to a brokerage. This is. Determine your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. Use this calculator to help compare employee contributions to the new after-tax Roth (k) and the current tax-deductible (k). Roth (k) vs Traditional (k) Calculator. Effect on your paycheck A Roth (k) could provide additional income of $ per year during retirement. To calculate your (k) at retirement we look at both We estimate your tax rate in retirement will be 19% vs your current estimated tax rate of 31%. Which (k) investment option will give you the best returns? When it comes to saving for retirement, it is important to explore all your retirement savings. Tax-deductible–Contributions to traditional IRAs and other retirement plans may or may not be tax-deductible, as they can depend on tax brackets and other. Access free K calculator from Black Hills Federal Credit Union in SD Spend or Invest in an IRA Calculator. Routing number: BHFCU. Roth IRA vs. Traditional IRA Calculator. An IRA can be an effective retirement tool. There are two basic types of Individual Retirement Accounts (IRA): the Roth. Use our Traditional vs. Roth Contribution Calculator to help you decide which new account type may better prepare you for retirement. Plan your retirement with Ent's Roth k Calculator. Compare Traditional vs. Roth contributions and maximize your savings. Calculate now! Home > Financial Calculators > Traditional k vs. Roth k Calculator. Traditional k or Roth k Calculator. The decision to save in a traditional k. Individual (k) · SEP IRA; Personal Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. On the other hand, a contribution to a Roth account reduces the amount of money left in your pocket compared with a similar contribution to a traditional. Our Roth vs. Traditional (k) Calculator helps you decide which investment will better prepare you for retirement. Find additional resources at. Retirement tax rate. The marginal federal income tax rate you expect to pay on your retirement account distributions. Keep in mind that the calculator does not. Compare Roth (k) and Traditional (k) Retirement Savings Plans Calculator. You should explore all of your retirement savings options in order to ensure. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. Free Roth k vs Traditional k Retirement Calculator for Nearly everyone thinks they should invest in a Roth k. But is it true?